5 Money Parenting Styles: Which One Do You Follow?

Money. That word alone can make parents either sit up straight with pride or slump in their seats with guilt. The truth is, when it comes to raising kids, our relationship with money doesn’t just stay with us. It spills over into our children’s world, whether we like it or not. I’ve seen parents unknowingly pass down habits both good and bad that shape how their kids will handle money years from now. And it’s not always intentional. Sometimes, it’s just the way we were raised ourselves, and the cycle keeps spinning.

Let me paint you a picture. Imagine you’re at the grocery store with your child, and they beg for the newest box of colorful cereal that costs twice as much as the regular one. Do you cave in with a sigh, thinking, “What’s one box?” Or do you stand firm and explain that money is for needs first, wants second? Maybe you strike a deal with them about chores or savings. Whatever you choose in that tiny moment speaks volumes about your “money parenting style.” These little day-to-day choices stack up over time and shape your child’s financial brain.

Now, parents in the US, UK, and other countries know the stakes are high. Life is expensive, opportunities are vast, and financial literacy can make or break a kid’s future. Whether it’s saving for college, helping them understand credit cards, or teaching them why money doesn’t just fall from the sky (though it sometimes feels like it falls right out of your wallet), your approach matters. Today, we’ll break down five common money parenting styles. By the end, you’ll probably recognize yourself in at least one or maybe you’ll discover it’s time to switch lanes for the sake of your kids.

The Five Money Parenting Styles

1. The Provider Parent

This style is rooted in love and sacrifice. Provider parents want to give their kids the life they never had. If their child wants the latest sneakers or that flashy iPad, they’ll find a way to get it. Their reasoning? “I don’t want my kids to suffer the way I did.” While generosity is beautiful, this style can unintentionally create kids who struggle with entitlement.

Think about it. If your child always gets what they want without understanding the effort behind it, how will they learn the value of earning? Provider parents often mistake giving for teaching. There’s nothing wrong with providing, but without boundaries, kids may grow up thinking money magically appears when they want it. It’s like feeding them dessert every night it feels good in the moment but doesn’t nourish long term.

2. The Strict Budgeter Parent

Picture a parent with color-coded spreadsheets and grocery lists that leave no room for impulse buys. Every cent is tracked, every purchase justified. Strict budgeters raise kids who know money doesn’t stretch endlessly. They’re taught discipline early, and these kids often grow up with solid saving habits.

But here’s the flip side. If money is always presented as something to fear or strictly control, children may grow up with anxiety around it. They might hesitate to spend even when they can afford to, or they might rebel later by overspending. It’s like teaching your child to walk, but only inside a tiny square when they step outside, they stumble. Balance is key here.

3. The Hands-Off Parent

This parent believes kids should figure it out themselves. Maybe they provide allowance without guidance, or they avoid money talks altogether. Hands-off parents often grew up in households where money was either taboo or chaotic, so they take a “learn by doing” approach.

The upside is that these kids might learn independence and self-reliance. The downside? They can also make avoidable mistakes that sting harder than they should. Imagine a teen maxing out their first credit card because no one ever explained interest rates. Ouch. Hands-off might feel like freedom, but it can also be like handing a kid the car keys without teaching them how to drive.

4. The Coach Parent

This style combines structure with freedom. The coach doesn’t just hand out allowance they attach lessons. For example, a child might earn extra money for extra chores, or they might be guided to split their allowance into spending, saving, and giving jars. Coach parents talk openly about money, explain their own choices, and encourage their kids to ask questions.

The beauty of this style is balance. Kids raised by coach parents often develop confidence and practical money skills. They don’t see money as scary or endless; they see it as a tool. But here’s the catch: coaching takes time and patience. It’s much easier to say yes or no than to sit down for a 15-minute discussion about why no means no. Still, those conversations are where the magic happens.

5. The Dream Builder Parent

Ah, the dreamers. These parents focus on long-term goals and encourage their children to do the same. They might set up savings accounts for college, talk about investing, or even involve their kids in family financial planning. Instead of focusing only on the now, dream builder parents emphasize the bigger picture.

This style instills hope and ambition. Kids learn to delay gratification and see money as a pathway to freedom. But there’s a potential pitfall if everything is about the future, kids might miss learning how to handle the everyday realities of money. You don’t want them to understand retirement accounts before they grasp how to budget for lunch money. It’s about balancing vision with practicality.

A Relatable Scenario

Last week, I was at a birthday party for one of my son’s classmates. After the cake, the kids swarmed the toy corner where the birthday boy had piles of presents. My son leaned over and whispered, “Dad, why don’t I get gifts like that every month?” In that moment, I had a choice. I could laugh it off, shut it down, or use it as a teaching moment.

I decided to play coach. I told him, “See those gifts? They’re special because it’s his birthday. If he got them all the time, they wouldn’t feel special. Money works the same way. When you save for something and finally get it, it feels bigger than if you just get everything right away.” He didn’t fully get it he’s eight, after all but the seed was planted. And that’s what these little conversations are about. Planting seeds that grow into money-smart habits.

Step-by-Step Guide: Choosing Your Style

- Identify Your Default Habits

Do you give in easily? Track every dollar? Ignore money talks? Notice your patterns before trying to shift them. - Assess Your Child’s Personality

Some kids respond better to structure, while others thrive with freedom. A strict budget might crush a free spirit, while hands-off parenting might leave a cautious child anxious. - Blend Styles When Necessary

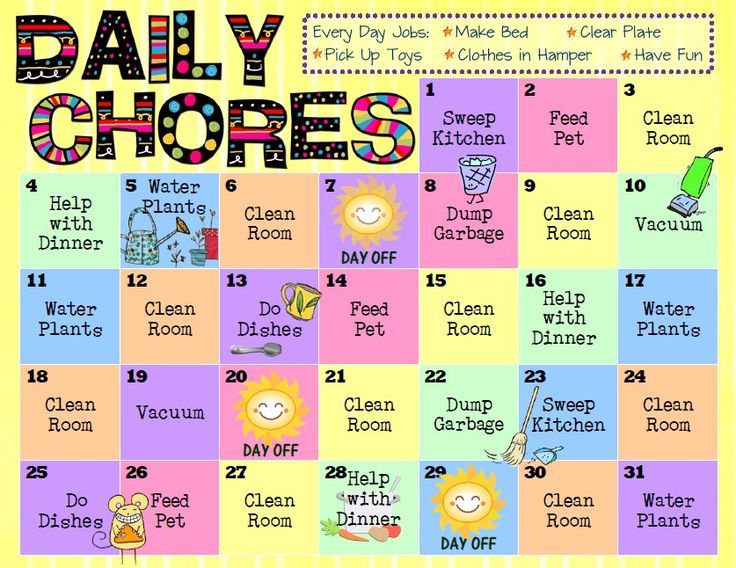

You don’t have to pick just one. Many parents find themselves mixing approaches depending on the situation. For example, you might be a provider at Christmas but a coach during allowance time. - Create Age-Appropriate Lessons

A five-year-old doesn’t need to understand compound interest, but they can learn that coins have value. A teenager, on the other hand, should definitely learn about credit and budgeting. - Commit to Conversations

Whatever your style, talk about money often. The more you normalize the topic, the less scary or confusing it will be for your kids.

FAQs Parents Often Ask

Q: How early should I start teaching my kids about money?

Start as soon as they can count. Kids as young as four can learn about saving versus spending. Don’t wait until they’re teenagers it’ll be like trying to teach someone to swim during a storm.

Q: What if I didn’t grow up with good money habits myself?

That’s okay. You don’t have to be perfect to guide your kids. In fact, sharing your mistakes can be powerful. Tell them about the time you overdrafted your account or blew money on something silly. Kids respect honesty more than perfection.

Q: Is giving an allowance a good idea?

Yes, if it comes with guidance. Allowance without teaching is just free cash. Use it as a tool to introduce saving, giving, and spending. Think of it as practice money for the real world.

Q: What if my spouse and I have different money parenting styles?

That’s common. The key is compromise. Talk about your differences and find a middle ground. Kids notice when parents are inconsistent, so work out your disagreements privately before setting rules for them.

Q: How do I know if I’m raising a “money successful” child?

It’s not about whether your kid is saving thousands by age 12. Look for signs like thoughtful decision-making, curiosity about money, and the ability to wait for what they want. Success is in the mindset, not the bank balance at least in the early years.

Final Thoughts

Parenting and money two of the most complicated, rewarding, and stressful topics in life. Mix them together, and you’ve got a recipe that can either build strong, resilient kids or leave them confused and unprepared. The good news? You don’t have to be flawless. You just need to be intentional. Whether you’re the provider, the budgeter, the hands-off, the coach, or the dream builder, remember this: your kids are watching more than they’re listening.

Every trip to the store, every bill paid, every allowance given is a lesson. Some days you’ll nail it, other days you’ll feel like you completely messed it up. That’s normal. What matters is that you keep showing up, keep talking, and keep guiding.

Parenting isn’t about raising kids who never stumble it’s about giving them the tools to stand back up when they do. Money works the same way. So whichever style you find yourself leaning toward, make it intentional, make it loving, and make it yours.

At the end of the day, teaching kids about money is like planting a tree. You may not sit under its shade today, but one day, your children will.