An Age-by-Age Guide to Giving Your Child a Chore-Based Allowance

Money. Chores. Kids. Three things that can make even the calmest parent feel like they’re trying to herd chickens on a windy day. When I first started giving my eldest a small allowance tied to chores, I’ll be honest — it felt awkward. I grew up in a house where chores were just expected, no payment attached. But as I talked with other parents, especially in the US and UK, I realised that many families are blending both ideas: teaching kids about money management while still keeping chores a part of family life. The result? Chore-based allowances.

If you’re reading this, you’re probably wondering how much to give, at what age, and whether paying kids for chores even works. Maybe your six-year-old is begging for money to buy a toy, or your teen wants more independence but you’re tired of them asking you for cash every weekend. This age-by-age guide isn’t a stiff rulebook; it’s a living, breathing approach from one parent to another. I’ve tried these methods, watched them flop, tweaked them, and tried again. That’s real life, isn’t it?

The key to making chore-based allowances work is knowing what’s age-appropriate. You don’t hand a toddler a fiver for folding laundry. At the same time, you don’t expect a 15-year-old to clean the entire garage for free if you’re trying to teach them about money. What follows is a simple but detailed guide that walks you through every age group, with practical tips, relatable examples, and a few hard-earned lessons from my own kitchen-sink battles.

Ages 3 to 5: The “Little Helpers” Stage

At this age, kids love helping, even if their “help” isn’t very helpful. They’ll happily splash water on the floor while “washing” dishes or scatter toys while “tidying up.” This is the perfect time to introduce the concept of chores, not as work but as part of family life.

For example, you might give them tiny jobs like putting napkins on the table, feeding the family cat, or picking up their toys. Do you give them money for it? That’s up to you. Some parents offer a very small coin (think 25 cents or 20p) just to make the idea of money tangible. Others just praise them. The point here is less about the cash and more about routine. This age is about learning responsibility in a fun, low-stakes way.

Keep the money conversation simple. If they earn coins, show them how to drop it into a piggy bank. Let them hear the clink. It’s a small thrill, and it plants the seed for saving. The goal isn’t to make them “work for money” but to connect effort with reward in a gentle way.

Ages 6 to 8: The “Money Has Meaning” Stage

By six or seven, kids start to understand that money buys things. They might even start negotiating — “I cleaned my room, can I get a pound?” This is when a chore-based allowance can really begin.

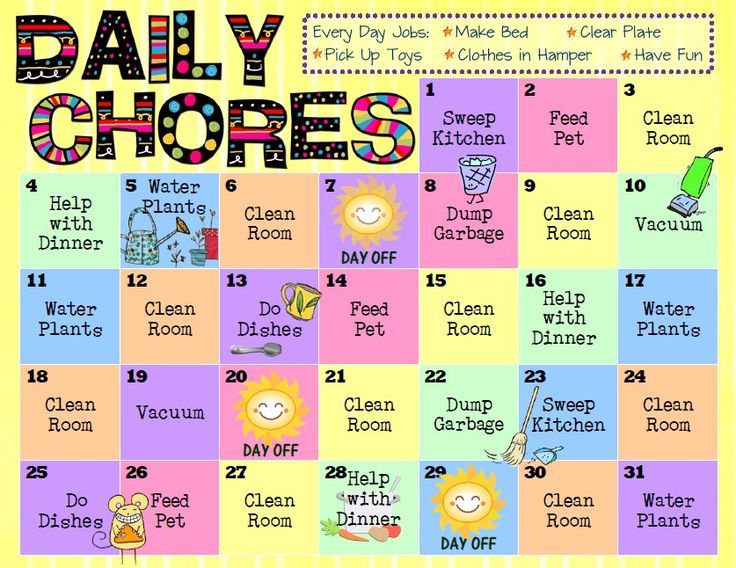

Choose a handful of age-appropriate chores. Think loading the dishwasher, helping to sort laundry, watering plants, or making their bed. Make a simple chart and keep it visible on the fridge. You could set a weekly allowance — maybe $3 or £2 — tied to their chores. Or you can pay per task. The important part is clarity. Kids this age thrive on structure.

Here’s a little trick I learned: give them jars labelled “Spend,” “Save,” and “Share.” When they earn money, let them divvy it up. It sounds simple, but it’s a game-changer. They’ll see their savings grow, plan for small purchases, and even think about giving. That’s money education baked right into everyday life.

Ages 9 to 11: The “Independence Sparks” Stage

Around this age, kids get more capable and more opinionated. They can handle bigger chores — raking leaves, vacuuming, helping prepare simple meals. They’re also starting to see money as more than coins. They may want to save up for video games, hobbies, or clothes.

This is the sweet spot for chore-based allowances. Consider a weekly allowance of $5–10 or £4–7, depending on your budget. Make expectations clear. If chores aren’t done, allowance isn’t paid. Some parents keep a “bonus” list — extra chores that earn extra money. It gives kids the chance to go above and beyond, which can be a great motivator.

It’s also a good time to have money conversations. Explain why saving matters. Show them how to set goals. Encourage them to pay for small extras themselves. By making the link between effort, earnings, and choices, you’re teaching financial responsibility that sticks.

Ages 12 to 14: The “Preteen Hustle” Stage

Now you’re entering the tricky years. Preteens want more autonomy but still need structure. They can handle more challenging chores: mowing the lawn, babysitting younger siblings for short stretches, deep cleaning the kitchen. This is also when they’ll start pushing back — “Why do I have to do this?”

With chore-based allowances at this stage, think of it as a small training ground for future jobs. Set a fair but realistic allowance, maybe $10–15 or £8–12 per week. Make sure they understand the system: chores done equals money earned. Missed chores? Lower earnings. This mirrors real life.

This is also a prime time to introduce budgeting. Help them plan for bigger purchases. Maybe they want a new phone accessory or to save for a school trip. Show them how to track progress. Some families even open junior bank accounts at this age. It gives kids a sense of independence and makes money management feel “grown up.”

Ages 15 to 17: The “Almost Adults” Stage

By the time your child is in their mid-teens, they’re probably juggling school, sports, friends, and maybe even a part-time job. Household chores should still be part of their routine, but you’ll need to adjust your expectations.

At this stage, a chore-based allowance can become more of a shared agreement. They might handle the heavier lifting — mowing the lawn regularly, doing their own laundry, helping with meal prep — in exchange for a set allowance. It could be $20 or £15 per week, or whatever fits your family’s budget.

The big shift here is letting them take more control. Help them learn to budget for their own social outings, clothes, or tech upgrades. They’re learning life skills now — responsibility, time management, financial literacy. It’s messy sometimes, but so is growing up.

Tips for Making Chore-Based Allowances Work

- Keep it simple. Kids lose interest if the system is too complicated.

- Be consistent. If chores are tied to allowance, stick to the plan.

- Praise effort, not just results. A messy attempt is still an attempt.

- Adjust as you go. What works at 8 might not work at 13.

Remember, the goal isn’t to create little employees. It’s to teach responsibility, effort, and money skills in a way that fits your family’s values.

Common Questions Parents Ask

Should kids get paid for every chore?

Not necessarily. Some chores can be non-negotiable “family duties” while others are tied to allowance.

What if my child refuses to do chores?

Stay calm but consistent. No chores, no allowance. Don’t cave. It teaches cause and effect.

How much is too much?

There’s no one-size-fits-all. Start small, watch how it goes, and adjust. The key is consistency.

Does paying for chores make kids entitled?

Not if you set clear boundaries. Frame it as learning about work and money, not bribery.

A Relatable Scenario

Last summer, my 10-year-old decided he wanted a skateboard. It cost more than his allowance could cover. We sat at the kitchen table with a scrap of paper and worked out how much he’d need to save. I offered “bonus” chores — washing the car, weeding the garden — for extra money.

It took him eight weeks, some grumbling, and a few late-night laundry-folding sessions. But he saved every penny. The day he bought that skateboard himself, he stood a little taller. That’s when I knew this chore-based allowance system wasn’t just about money. It was about grit, patience, and pride.

Wrapping It All Up

Giving your child a chore-based allowance isn’t about creating little workers or keeping your house spotless. It’s about teaching them real-world skills in a way that feels fair, consistent, and encouraging. It can be messy. It can be funny. It can even feel awkward at first. But it’s worth it.

If you start small, stay consistent, and adjust as they grow, you’ll be amazed at how much your kids can learn — about money, responsibility, and themselves. So next time your child asks for money, or you’re standing in the kitchen wondering how to teach them about finances, why not give this system a try? Could this be the start of their lifelong money habits?