How to Teach About Money Through Play (For Kids)

Growing up, money was never explained in my family. It wasn’t talked about at the dinner table, it wasn’t shown in practical ways, and it certainly wasn’t a skill my parents thought kids should learn. I remember thinking cash just appeared when my dad pulled it from his wallet. I thought bills were something adults magically handled behind closed doors. When I left for college, reality smacked me hard. Suddenly I had credit card offers flying at me, rent deadlines, and no clue how to budget more than a week at a time. I loved my parents, but they hadn’t set me up for financial survival. They taught me kindness, respect, and good values, but when it came to money, they left me empty-handed.

Everything changed one summer when I stayed with a family friend. Their kids were just seven and ten, and I was amazed at how confidently they spoke about saving and spending. These weren’t mini accountants in stiff clothes. They were normal kids, giggling while counting coins, arguing about who got to be the banker in Monopoly, and bragging about how much they had saved in their “share jars.” The little one even explained to me, with his gap-toothed smile, that if he saved half the money for a bike, his mum would match it. I was floored. How were kids talking about money with such ease, while I an almost grown adult could barely balance my pocket money?

That summer opened my eyes. I saw a family who made financial learning part of everyday life. Not through boring lectures, but through play. They were raising confident, smart kids who weren’t scared of money talk. I promised myself that when I had kids, I’d break the cycle. I’d teach them what I never learned. And I’d do it in a way that made sense to children: through play, imagination, and simple fun. If you’re reading this, maybe you’ve felt that same tug that desire to give your kids what you didn’t have. Or maybe you’re just curious whether teaching about money through play really works. Let’s dig in, parent to parent.

Why Play Way Method Works

Children soak up lessons best when their hands are busy and their minds are curious. They don’t want stiff lectures about saving percentages or compound interest. But they will happily play store, sell you pretend cookies, and count out coins with pride. Play removes the pressure. It makes the lesson feel natural, like breathing.

Parents in the US, UK, and beyond often say money is a “grown-up” topic, but kids are watching anyway. They see you swipe cards, they see you shop online, they hear “we can’t afford it” without knowing what it means. Play becomes the bridge. Through it, they can practice what it means to earn, save, and spend all in a safe, lighthearted way.

Step by Step Guide: How to Teach About Money Through Play

Step 1: Pretend Shops at Home

Start simple. Grab toy coins, buttons, or scraps of paper. Set up a small shop in your living room with items priced in pretend money. Let your child be the shopkeeper and you the customer. Then switch roles. In just half an hour, they’ll learn that goods have value, money is exchanged, and choices must be made.

Step 2: Grocery Game in Real Life

Next time you’re at the store, give your child a small budget say five dollars or five pounds and let them pick snacks or fruits within that amount. Suddenly, they’re not just grabbing cereal for the cartoon on the box. They’re comparing prices, counting change, and realizing money runs out. That’s real-life math wrapped in fun.

Step 3: The Saving, Spending, Sharing Jars

This one is magic. Give your kids three jars labeled Save, Spend, and Share. Every allowance or gift money gets split into these jars. Over time, they see savings grow, enjoy the freedom of spending, and feel proud when they give a little to someone in need. It’s hands-on budgeting without the boring charts.

Step 4: Family Board Games

Dust off Monopoly, Payday, or even The Game of Life. These games, though designed for fun, sneak in lessons about buying, trading, borrowing, and even losing. Yes, Monopoly can take hours, but kids remember those moments where a choice either worked or backfired. And they learn negotiation too an underrated money skill.

Step 5: Role Play Careers

Kids love pretending. Set up a “restaurant” where one child is the cook and another is the cashier. Print fake menus with prices. Pay them in pretend bills, and let them make change. Or let them “be the banker” for a day. The sillier it is, the deeper the learning goes.

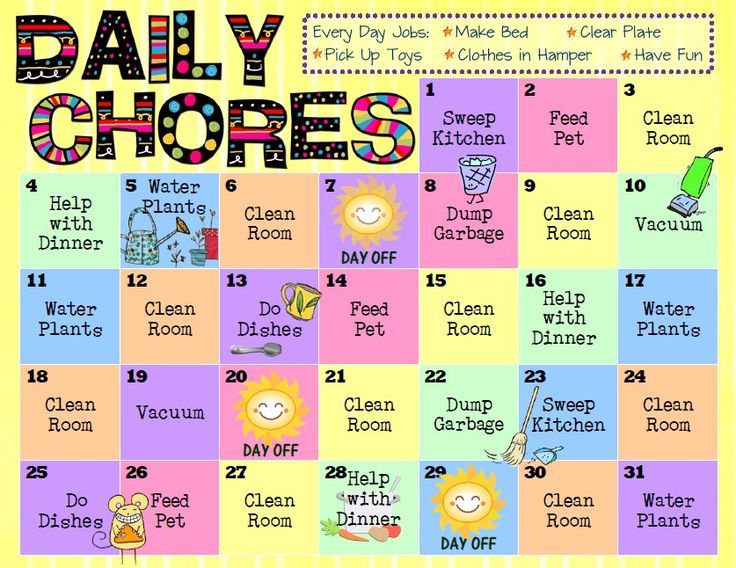

Step 6: Chores that Earn Extra

I’m not saying every chore should be paid basic responsibilities are just part of family life. But give them a chance to earn with extras. Washing the car, helping with gardening, or organizing books can earn small rewards. They quickly connect effort to earning, which is the foundation of all work.

Step 7: Use Kid-Friendly Apps

In the US and UK, apps like GoHenry or PiggyBot gamify saving and chores. Your child sees their balance grow on-screen, sets goals, and feels accomplished when they reach them. Since kids already love screens, these tools make financial play modern and engaging.

A Relatable Scenario

Let me paint a scene. It’s a rainy Saturday. Everyone’s cranky. Instead of handing them tablets, you say, “Let’s open a shop.” Suddenly, the living room turns into a supermarket. Your son sells you “apples” (toy blocks), your daughter offers “milk” (a pillow), and you’re counting out coins. They argue about prices, and you sneak in a lesson about competition. By the end of the afternoon, you’ve laughed, bonded, and planted seeds about how money works. That’s the magic of play it doesn’t feel like school, but the lessons stick.

Extra Tips Parents Forget

- Model the behavior: Kids watch more than they listen. If you say saving is important but splurge nonstop, they’ll notice.

- Keep it consistent: A short money game once or twice a month beats an intense one-off lecture.

- Don’t overcomplicate: Avoid dumping big financial terms. Keep it at their level.

- Praise effort, not results: If they try to save but spend early, clap for the attempt. Mistakes are part of learning.

FAQs Parents Ask

Isn’t it too early to teach kids about money?

No. A three-year-old can understand trading a coin for a toy. Early seeds grow into strong habits later.

Won’t this make them money-obsessed?

Not if it’s balanced. When money is taught alongside values like sharing and gratitude, kids see it as a tool, not an idol.

Do I need fancy tools?

No. Coins, paper scraps, and imagination are enough. The key is interaction, not expensive props.

What if I’m not good with money myself?

That’s fine. You’re learning together. In fact, your honesty about past mistakes can become a powerful lesson.

How do I handle different ages?

Keep it age-appropriate. A five-year-old can run a pretend shop, while a twelve-year-old can manage a digital allowance.

The Deeper Benefits

Teaching kids about money through play isn’t just about math or saving. It’s about raising confident decision-makers. Kids who understand money early tend to make better choices as adults. They don’t panic at their first bill, they don’t swipe cards recklessly, and they’re less likely to drown in debt.

It also builds character. When a child puts coins into a “share jar” and later donates, they see generosity in action. When they save for a toy and finally buy it, they feel pride. These small wins build resilience, patience, and self-control. And isn’t that what we want for them?

Sprinkling in Some Slang

Picture this: Your kid saves for months and finally buys that skateboard. In the UK, you’d probably hear them shouting, “I’m buzzing, Mum!” In the US, they might run to you saying, “Look, Dad, I’m ballin’ with my own cash!” It’s cheeky, it’s playful, but it’s also proof that the lesson stuck. They’re connecting money with independence, not entitlement.

Common Mistakes to Avoid

Some parents go too heavy, turning money play into lectures. Don’t. Kids tune out fast when it feels like school. Others make the mistake of using money as punishment—like taking away savings for misbehavior. That sends the wrong signal. Keep money lessons separate from discipline.

And please don’t overshare adult stress. Kids don’t need to know about mortgage struggles or late fees. Keep it light, practical, and age-friendly.

Final Thoughts

I often think back to that summer with the other family. Their kids weren’t special geniuses. They were simply given tools and space to learn through play. And now, years later, I see how much that inspired me. My own kids already surprise me with their money smarts, and it’s not because I gave them lectures. It’s because I played with them, laughed with them, and used everyday moments to teach.

If you’re wondering whether this method sheds real results, I’d say yes absolutely. It sheds fear, it sheds ignorance, and it sheds the cycle of raising money-clueless adults. You don’t need perfection. You just need patience and a willingness to try. Step by step, jar by jar, game by game, you’re shaping not just your child’s relationship with money, but their confidence in life.

So, parent to parent, are you ready to turn playtime into the most valuable classroom your child will ever have?