20 Things to Teach Your Child About Finances

I’ve spent enough time working the land and running a small farm to know that money works a lot like the soil. You can plant it, tend it, and watch it grow. Or you can ignore it and be surprised when weeds show up. When my kids were small, I realized no one at school was going to teach them about money in a real-world way. Sure, they’d get math problems about coins, but no one was going to explain how to save for a bike or why a credit card bill can bite you back. That’s why I decided to make financial lessons part of everyday life.

Money lessons don’t have to be stiff or complicated. They can happen at the grocery store checkout, at the farmers market, or even while sitting at the kitchen table dividing up the eggs you just collected. In the US, UK, and other countries where kids have more exposure to spending than saving, starting early matters. And guess what? You don’t need a finance degree to do it. You just need to be willing to talk and show.

If you’re a parent like me — busy but wanting your child to have a solid footing — these tips can help. They’re not perfect or fancy, but they’re the things that have worked for me and for other farm families I know. And they’re simple enough to weave into daily life, whether you’re in a city apartment or out on a rural lane.

20 Things to Teach Your Child About Finances

Here are 20 things to teach your child about finance this season;

1. Money Doesn’t Just Appear

Let your kids see you work. Whether you’re selling produce at a market or clocking in at an office, explain that money is earned. When they understand effort comes before spending, they respect it more.

2. Saving Before Spending

Whenever your child gets allowance or birthday money, show them how to save a slice first. A jam jar labeled “savings” works better than a lecture. Watch their pride when the jar fills up.

3. Needs vs. Wants

Use everyday examples. Milk and bread? Needs. Extra sprinkles or the newest video game? Wants. This simple habit sticks with them.

4. Setting Simple Goals

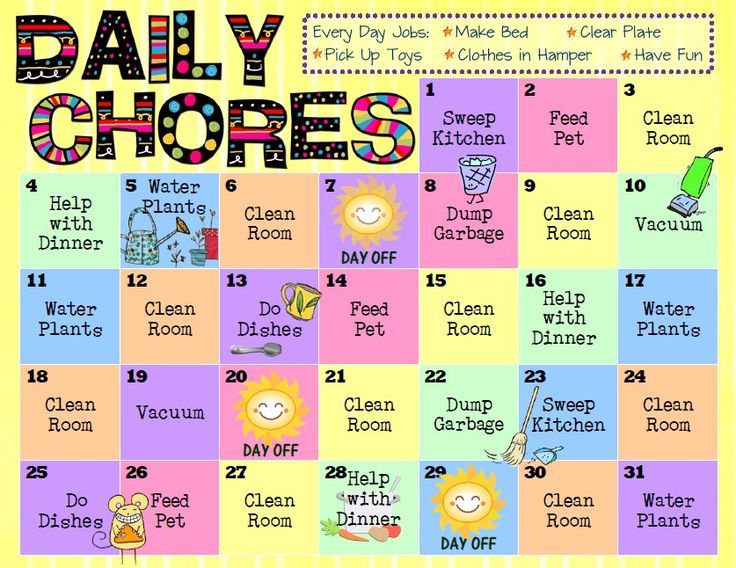

Help them choose a goal like a new bike or school trip. Mark progress on a chart. Kids love seeing how close they’re getting.

5. How Banks Work

Take them along to the bank or show an online account. Let them deposit their own money and check their balance. It makes saving feel real.

6. Interest Explained Simply

Use beans, coins, or marbles. Add one every week to show how saved money grows. This is an easy intro to interest without the jargon.

7. Budgeting Basics

Teach them a three-way split: spend, save, give. Let them manage it on paper or with envelopes. Budgeting becomes a habit, not a chore.

8. Delayed Gratification

If they want something big, show how waiting and saving leads to a bigger reward. This skill helps them resist impulse buys later in life.

9. Giving Back

Encourage them to donate a small part of their allowance. Whether it’s to a church, charity, or local shelter, it builds empathy and a sense of community.

10. Price Comparisons

At the grocery store or farm supply shop, show them two similar items with different prices. Ask them which is smarter to buy and why.

11. How Debit Cards Differ from Credit

Kids think cards are magic. Show them a bank card draws from your money, while a credit card borrows. Simple but eye-opening.

12. Debt Can Be Dangerous

Tell a small story about someone who borrowed too much and had to pay it back with interest. Nothing scary, just real.

13. Compound Interest is Magic

Explain how small, regular savings or investments can snowball over years. Use a simple graph or chart to make it stick.

14. Working for Extra Income

If they’re old enough, let them do extra chores for extra pay. It teaches hustle and gives them ownership of their earnings.

15. Entrepreneurship Basics

Encourage them to sell lemonade, crafts, or even eggs from backyard chickens.

16. Tracking Spending

Kids are amazed when they actually write down what they buy. Hand them a small notebook or let them use an app. At the end of the week go over it together. It’s a gentle way to show where money leaks out.

17. Understanding Taxes

When my son got his first summer job at the farm stand he couldn’t believe part of his pay went missing. That’s the time to explain taxes — who collects them and why. Keep it simple but honest.

18. Planning for Big Life Goals

College, a car, travel, even starting a small business — talk about how big dreams need early planning. Let them sketch out a rough plan for something they want years down the road. It builds a “think ahead” habit.

19. Basic Investing

When they’re a bit older, explain what stocks, mutual funds or savings bonds are. You don’t have to be an expert. Just show that money can work for them, not only be spent.

20. Money Isn’t Everything — But It Gives Freedom

End on a balanced note. Teach your child that money is a tool, not a measure of their worth. It can buy choices, help others, and ease stress, but it’s not the only thing that matters.

Bringing It All Together

None of these lessons need to be perfect or formal. In my own home and on my own farm, money chats happen while we’re collecting eggs, at the grocery checkout, or on the way to the feed store. Kids remember the moments you involve them, not the lectures you give. And when they grow up, they’ll have a mental “toolbox” that’s a lot sturdier than most adults had starting out.

Common Questions Parents Ask

At what age should I start?

You can start as soon as they can count. Even preschoolers can put coins into jars for saving, spending, and giving.

Do allowances matter?

They can help, but the key is pairing them with lessons about saving and planning. Without the lessons, an allowance is just spending money.

How do I keep it fun?

Use games, challenges, and visuals. Let them pick a goal and track progress. Turn “boring” topics into mini-projects.

What about mistakes?

Let them make small ones while the stakes are low. Blowing five dollars on candy is better than blowing five thousand on a bad car loan later.

A Warm Wrap-Up

Teaching kids about money isn’t a one-off talk; it’s a set of little seeds you plant over time. Just like planting rows in a field, some seeds sprout fast, others take a while. Be patient, repeat the lessons, and keep it positive. You’re not trying to raise a stockbroker; you’re trying to raise a thoughtful adult who understands how money works and how it can support the life they want.